Here’s everything you need to know to set up payments on Ghost CMS, with Stripe as your gateway. Stripe supports GBP (£), multiple payment methods, and subscription tiers for memberships.

Why it matters:

- 83% of UK consumers use contactless payments.

- Smartphone-based payments will attract 3 million more users by 2026.

- 77% of buyers abandon purchases if their preferred payment method isn’t available.

Key steps to get started:

- Set up a Stripe account and connect it to Ghost.

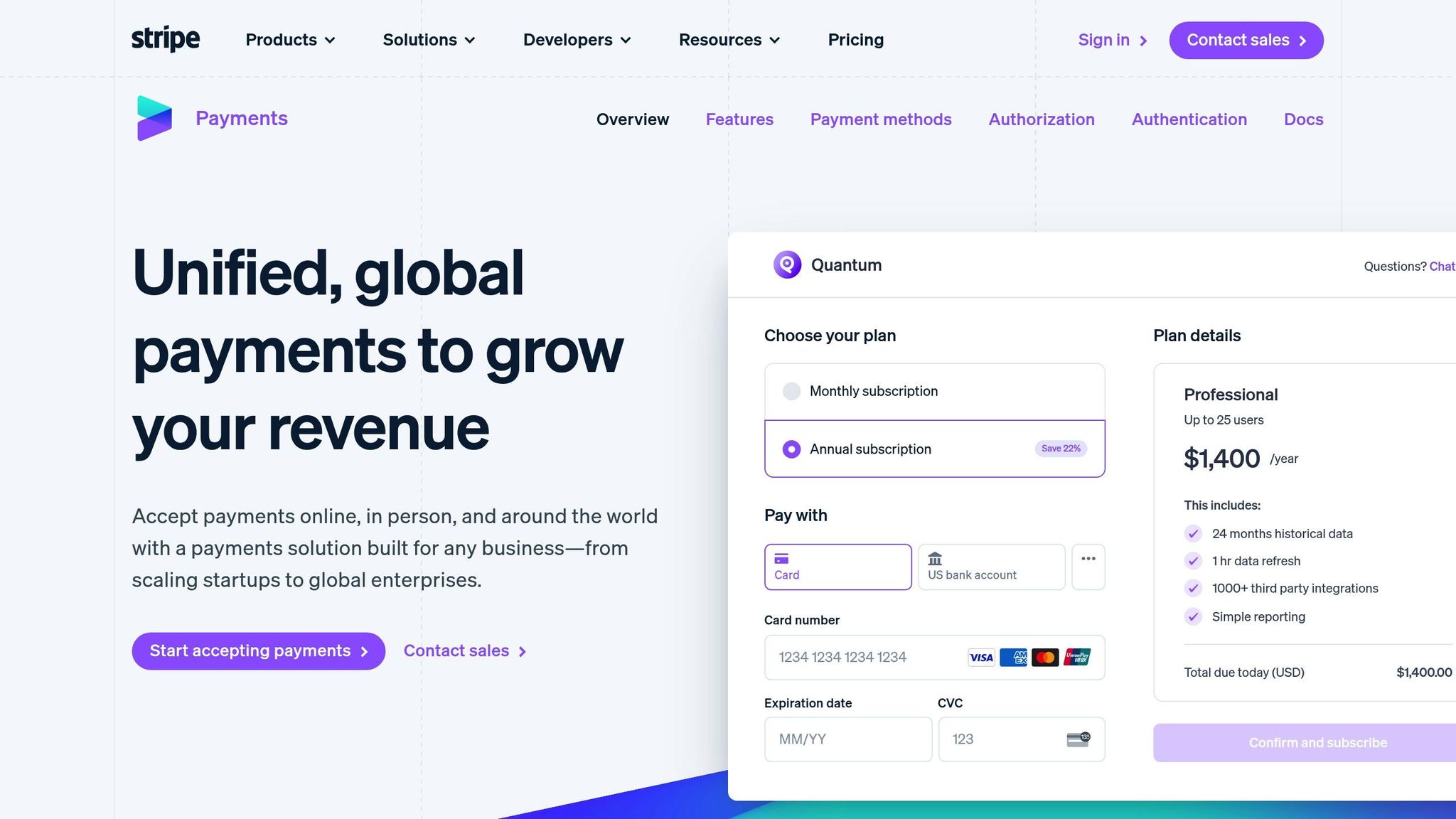

- Configure subscription tiers in GBP (£) with monthly or yearly billing options.

- Test your payment system using Stripe’s test mode.

- Offer multiple payment methods like credit cards, Apple Pay, and Google Pay.

Stripe’s built-in tools – like fraud prevention, analytics, and global currency support – make managing payments easier. Plus, Ghost CMS doesn’t charge extra transaction fees, so you keep more of your earnings.

Pro tip: Optimise for mobile payments since 79% of smartphone users shop on their phones.

Selecting Payment Gateways for Ghost CMS

Payment Options for Ghost CMS

Ghost CMS works seamlessly with Stripe, enabling you to accept payments through credit cards, Apple Pay, Google Pay, and other methods like iDEAL, WeChat, Revolut, and AmazonPay. Transactions can be processed in British pounds (GBP), and the platform supports easy subscription management.

These payment methods make it easier to choose a gateway that fits your business needs.

Payment Gateway Selection Criteria

When choosing a payment gateway for your Ghost CMS website, keep these key factors in mind:

| Criteria | Details | Impact |

|---|---|---|

| Setup Requirements | SSL certification and HTTPS setup | Essential for self-hosted sites before integrating Stripe |

| Transaction Fees | Standard Stripe pricing structure | Varies depending on plan (£9–£299/month) |

| Currency Support | Over 135 currencies supported | Expands payment options for global users |

| Integration Level | Native vs third-party integration | Influences reliability and maintenance |

| Payment Methods | Cards, digital wallets | Boosts conversion rates |

Stripe also offers features like smart retries for failed payments, automated email notifications, customisable checkout pages with your branding, and built-in analytics.

Ensure your business aligns with Stripe's list of prohibited and restricted activities. To manage your finances effectively, link a dedicated business bank account to your Stripe account.

If you're migrating your site, use the same Stripe account to avoid interruptions in payment processing. Ghost's built-in Stripe integration makes it simple to create premium subscription tiers. These tiers automatically sync with your Stripe account, making payment management straightforward. This is especially helpful for content creators aiming to build steady revenue through memberships and subscriptions.

Setting Up Stripe on Ghost CMS

Stripe Account Setup and Integration

Before getting started, make sure your website has an SSL certificate and uses an HTTPS URL. If you're a Ghost(Pro) user, integrating Stripe is straightforward.

Here’s how to set up your payment system:

1. Create Your Stripe Account

Set up a new Stripe account or link an existing one if you already have one in use.

2. Connect Stripe to Ghost

Go to the Ghost Admin dashboard, navigate to Settings > Payments, and select "Connect with Stripe". After logging into Stripe, copy the secure key provided and paste it back into Ghost Admin. Make sure to hit "Save Stripe settings" to complete the setup.

Configuring Membership Plans in GBP

Once Stripe is connected, you can set up membership plans with GBP (£) as the currency.

| Plan Component | Configuration Options | Notes |

|---|---|---|

| Currency Setting | GBP (£) | Ideal for UK-based creators |

| Billing Cycles | Monthly/Yearly | Adjustable to your needs |

| Payment Methods | Cards, Digital Wallets | Supports multiple options |

| Plan Features | Basic/Premium/Enterprise | Customise access levels |

Testing Your Payment System

After configuring your account and membership plans, it's essential to test the payment process.

- Use Stripe's test mode to simulate various scenarios:

- Process test transactions with sample card details

- Check webhook functionality

- Manage subscription cancellations and renewals

- Simulate payment successes, failures, declines, and authentication prompts

For more advanced testing, Stripe’s Sandbox environment provides a secure space to trial features without affecting live data.

A key advantage of Ghost is that it doesn’t impose extra transaction fees or take a commission on your earnings, making it a budget-friendly choice for creators who want to monetise their content.

Managing Ghost CMS Payment Restrictions

Current Payment System Limits

Ghost CMS's built-in payment system is tightly linked to Stripe, which comes with certain limitations on how payments are processed.

Payment Gateway Restrictions

- Ghost CMS natively supports Stripe as the main payment processor.

- Transaction fees through Stripe can affect overall costs.

Member Management Constraints

- Relies on passwordless JWT email-link logins for user authentication.

- Uses server-level mechanisms to protect content.

These limitations highlight the need for alternative approaches, which are explored below.

Solutions and Custom Options

Creators can bypass these limitations by incorporating custom integrations and automated workflows. These methods allow flexibility while maintaining secure payment and membership systems.

Alternative Payment Integration

| Integration Method | Implementation Details | Ideal For |

|---|---|---|

| Zapier Connection | Simplifies member onboarding | Supporting multiple payment sources |

| Ghost API | Enables tailored payment flows | Users with technical expertise |

| CSV Import | Allows bulk member uploads | Migrating from other platforms |

Custom Development Solutions

-

External Payment Processing

Use third-party payment providers to handle member creation while ensuring content remains secure. -

Automated Workflows

Set up automation tools to streamline membership management and enforce server-level access controls for payments made via various platforms.

Pro Tip: If you're using alternative payment systems, make sure to disable free member signups to keep access controls in check.

Making a Membership Site Using Ghost Website Builder

Improving Payment User Experience

A smooth payment process is key to driving content monetisation. With 70% of online shopping baskets being abandoned, simplifying payment systems is crucial for improving conversions.

Focusing on secure payment systems is just the start - designing with the user in mind can make a big difference in reducing drop-offs.

Payment Page Design and Branding

Once security is in place, attention should turn to the design of the payment page. The goal is to maintain brand consistency while ensuring a professional and user-friendly interface.

Key Design Features

- Stick to your brand's colour palette and typography.

- Clearly display security badges for user reassurance.

- Use a clear visual hierarchy to guide the user.

- Ensure layouts are responsive for all devices.

For example, simplifying a payment process can reduce confusion and encourage users to complete their purchase, leading to higher revenue.

Reducing the number of questions or fields on payment forms can also lead to higher completion rates.

Mobile Payment Optimisation

With mobile shopping on the rise - 79% of smartphone users made mobile purchases between late 2022 and early 2023 - it’s essential to optimise payment systems for mobile devices.

| Feature | Implementation | Example |

|---|---|---|

| Dynamic Keyboards | Automatically adjust keyboards based on input type | Nike's checkout process |

| Thumb-Friendly Design | Place call-to-action buttons within easy reach | Advance Auto Parts' mobile layout |

| Form Optimisation | Use 16px+ font sizes to prevent iOS zooming | Apple's payment forms |

| Address Entry | Use geolocation for faster form completion | Target's location-based system |

Membership Plan Structure

A well-structured membership plan can further enhance the user experience. Research indicates that membership pages offering tiers starting at £3–£5 tend to convert better than those starting at £1.

Suggested Tier Breakdown

- Entry Level: £5/month - basic access and early content.

- Mid Tier: £10/month - expanded access and exclusive content.

- Premium Tier: £20/month - full access plus personalised benefits.

Tips for Structuring Benefits

- Clearly differentiate the benefits of each tier.

- Make higher tiers more appealing with added value.

- Ensure benefits are practical and can be delivered consistently.

- Display pricing in GBP and offer both monthly and annual payment options.

- Emphasise savings for users who choose annual subscriptions.

Conclusion: Implementing Payment Systems

Having secure and efficient payment systems in place is key to generating revenue. With the UK ecommerce market expanding, content creators have more opportunities than ever to establish reliable income streams.

Implementation Checklist

Before launching, ensure these key areas are addressed:

Technical Requirements

- Confirm all technical and security measures are in place.

- Set up 3D Secure authentication to help prevent fraud.

Payment Setup

- Open a dedicated Stripe account.

- Configure subscription tiers in GBP.

- Enable local payment options, as 83% of UK users prefer contactless payments.

- Set up SEPA transfers to handle international payments.

Getting Started with Monetisation

Once your payment system is secure, shift your focus to monitoring revenue and staying compliant with tax regulations. The creator economy is expected to grow from £196 billion in 2023 to £377 billion by 2027, offering plenty of room for growth.

Key Steps

- Use Stripe analytics to track how your payment system is performing.

- Maintain detailed transaction records for compliance in the UK.

- Review and adjust your pricing strategy regularly.

- Ensure you meet VAT requirements at the standard 20% rate.

| Monetisation Focus | Priority | Consideration |

|---|---|---|

| Payment Security | Immediate | Fraud prevention |

| User Experience | First month | Mobile checkout |

| Revenue Tracking | Ongoing | Performance analysis |

| Tax Compliance | Quarterly | VAT documentation |

FAQs

How can I securely set up a payment system on Ghost CMS while complying with UK regulations?

To securely set up a payment system on Ghost CMS and ensure compliance with UK regulations, start by connecting your Ghost site to Stripe through the Settings → Payments section. Make sure your site uses an SSL certificate and is configured with an https URL. This helps protect sensitive data and ensures secure transactions.

Compliance with the Payment Card Industry Data Security Standard (PCI DSS) is essential for safeguarding customer information and avoiding penalties. Additionally, use encryption protocols like SSL and TLS to secure payment data during transmission, and enable authentication measures such as CVV checks and two-factor authentication (2FA) to prevent unauthorised transactions. For added security, consider implementing fraud detection tools that monitor transactions in real time.

Finally, ensure transparency in your payment processes and promotional materials to meet UK advertising and consumer protection guidelines. This includes clearly labelling any partnerships or sponsored content. By following these steps, you can provide a secure and seamless payment experience for your audience.

What benefits does Stripe offer for content creators using Ghost CMS?

Stripe provides a seamless integration with Ghost CMS, making it easy for content creators to accept payments securely and efficiently. It supports a customisable checkout experience, allowing you to tailor the payment process to suit your audience. Additionally, Stripe automates payment management tasks, such as recurring billing and refunds, helping to save time and reduce manual effort.

Another key advantage is its support for dunning services, which help minimise revenue loss by addressing failed payments. With Stripe, you can also accept payments in multiple currencies, including GBP (£), ensuring accessibility for a global audience while aligning with UK-specific needs. Its robust security features and user-friendly setup make it an excellent choice for creators looking to monetise their content effectively.

How can I design my payment page to improve user experience and reduce abandoned checkouts?

To improve the user experience and reduce checkout abandonment, start by being transparent about all costs, including taxes and delivery fees, early in the process. This helps build trust and avoids unpleasant surprises. Use a clear and simple layout with a progress indicator to guide users through the checkout journey.

Offer a variety of payment methods, such as credit/debit cards, PayPal, and mobile wallets, to cater to different preferences. Allowing guest checkouts is also crucial, as forcing account creation can discourage potential customers. Additionally, enhance trust by including security badges or seals and ensuring your payment page is mobile-friendly.

Keep the design clean by minimising unnecessary form fields and distractions. Ensure buttons and microcopy clearly state the next step, especially when using third-party payment options. Small changes like these can make a big difference in creating a seamless and secure checkout experience.